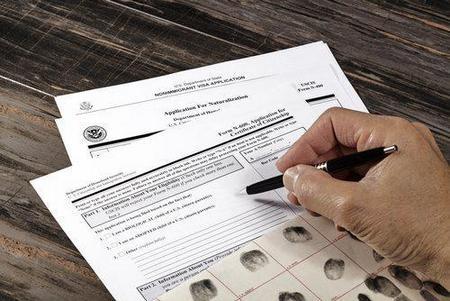

Should I Naturalize?

It is quite common in this day and age for foreign nationals to live in the United States for long periods of time without naturalizing their citizenship, primarily for professional and financial reasons. However, for the average person, many simply do not realize the benefits that come with becoming a U.S. citizen. If you have the choice before you regarding whether or not to naturalize, it is very important that you know the positives and negatives both before making any decisions.

It is quite common in this day and age for foreign nationals to live in the United States for long periods of time without naturalizing their citizenship, primarily for professional and financial reasons. However, for the average person, many simply do not realize the benefits that come with becoming a U.S. citizen. If you have the choice before you regarding whether or not to naturalize, it is very important that you know the positives and negatives both before making any decisions.

Advantages

One might imagine that many advantages of becoming a U.S. citizen are self-evident, especially if one has business interests in the country. Citizenship is the only way to entirely avoid the spectre of deportation, as even lawful permanent residents (LPRs, or ‘green card’ holders) are susceptible to being deported if they are found guilty of certain crimes. Citizenship may be taken away, but there is a very specific, narrow set of circumstances that would need to occur for one’s naturalization to be revoked. Also, a citizen does not have to assiduously maintain a residency in the country; if he or she wishes to spend time abroad, he or she may do so without facing any kind of immigration penalty upon his or her return.

The U.S. tax picture also differs substantially between citizens and permanent residents. For example, a deduction in estate taxes is generally permitted for a person’s surviving spouse. If you, the surviving spouse, are not a U.S. citizen, no deduction is allowed. Without a deduction, estate taxes must be paid on all estate valued over $1 million, which can cause significant hardship to some people. If you are a citizen at the time of your spouse’s passing, you may save significant amounts of money.

Disadvantages

Potential problems do exist for U.S. citizens. There are tax and other financial issues that can be seen as disadvantageous, just as the estate tax provision is advantageous. Namely, the U.S. requires that its citizens pay tax on all worldwide income, rather than solely on income earned within U.S. borders, unless your country has a tax treaty with the United States. It is also required that you report any foreign bank account which has a balance of over USD $10,000 at any point during the year, which may be difficult to comply with depending on the state of affairs in the foreign country.

The other tangible disadvantage of naturalizing is that depending on the country, you may be forced to surrender your citizenship from your home country. While many countries, including the United States, tacitly permit dual citizenship, others do not. If your home country does not allow dual citizenship, you may have to renounce it, which can cause problems if you return home for any reason. (For example, a naturalized U.S. citizen from Saudi Arabia may have significant difficulties entering the country on a U.S. passport, but Saudi Arabia does not permit dual citizenship, so they would likely have no choice.)

Consult an Attorney Before Deciding

Ultimately, a professional’s input may help you to make your decision. A competent immigration attorney can help shed light on any remaining questions you may have, and if you decide to naturalize, he or she can then help you through the process. The DuPage County naturalization lawyers at Mevorah & Giglio Law Offices are happy to help you make this decision and to help guide you on whichever path you choose to take. Contact us today at 630-932-9100 or via our website to schedule a free consultation.

English,

English,

Spanish,

Spanish,

Polish,

Polish,

Urdu

Urdu

Make a Payment

Make a Payment